Riding the Wave: Investment Trends to Watch

In the fast-paced world of investments, staying ahead of the game is crucial. As we look towards the next year, it’s important to keep an eye on the emerging trends that could shape the future of the market. By riding the wave of these investment trends, you can position yourself for success and maximize your returns. Here are some key trends to watch out for in the coming year:

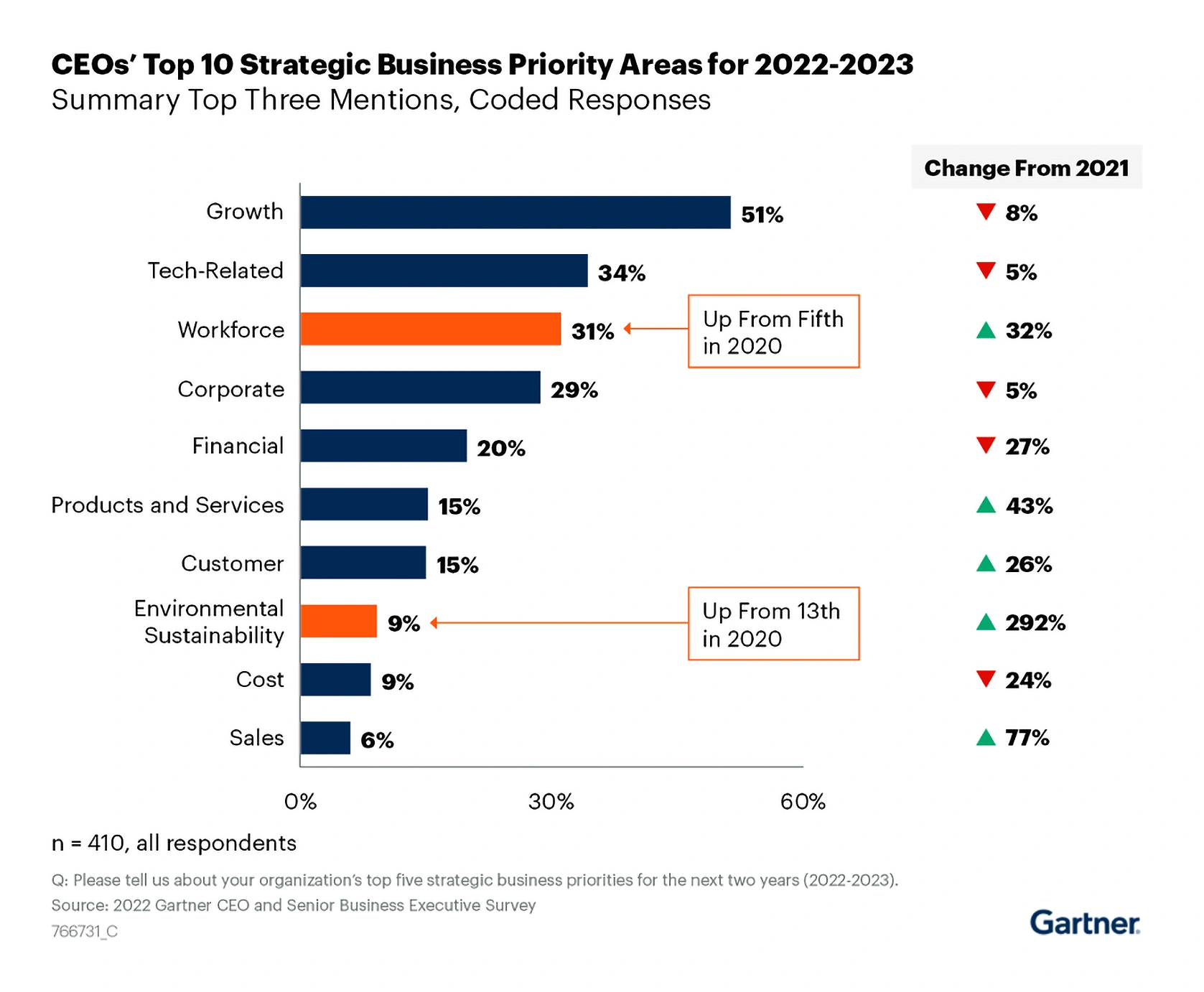

1. ESG Investing: One of the biggest trends in the investment world right now is ESG (Environmental, Social, and Governance) investing. This approach focuses on investing in companies that prioritize sustainability, social responsibility, and good governance practices. As more investors become socially conscious and demand transparency from the companies they invest in, ESG investing is set to continue growing in popularity in the next year.

2. Technology Sector: The technology sector has been a driving force in the market for years, and that trend is not likely to change anytime soon. With advancements in areas such as artificial intelligence, cloud computing, and cybersecurity, investing in tech companies can be a lucrative move. Keeping an eye on emerging tech trends and disruptive technologies will be key to staying ahead in the market.

3. Healthcare Innovation: The healthcare sector is another area that is ripe for investment opportunities. With the ongoing pandemic highlighting the importance of healthcare innovation, companies that are developing cutting-edge treatments, medical devices, and digital health solutions are likely to see significant growth in the coming year. Investing in healthcare innovation can not only lead to financial gains but also contribute to improving global health outcomes.

Image Source: buttercms.com

4. Renewable Energy: As the world continues to push towards a more sustainable future, investing in renewable energy sources such as solar, wind, and hydroelectric power is becoming increasingly popular. With governments around the world implementing policies to reduce carbon emissions and combat climate change, companies in the renewable energy sector are poised for growth. Keeping an eye on developments in this space can lead to profitable investment opportunities.

5. Digital Currencies: The rise of digital currencies such as Bitcoin and Ethereum has captured the attention of investors worldwide. While the volatility of cryptocurrencies can be a deterrent for some, the potential for high returns and the growing acceptance of digital currencies in mainstream finance make them an investment trend to watch. As the market for digital currencies continues to evolve, staying informed and being strategic in your investments will be key to success.

By staying ahead of these investment trends and riding the wave of change, you can position yourself for success in the next year. Whether you’re a seasoned investor or just starting out, keeping a close eye on emerging trends and being willing to adapt to the changing market landscape will be crucial. So buckle up, stay informed, and get ready to ride the wave of investment trends in the exciting year ahead.

Stay Ahead of the Game with These Hot Tips

In the fast-paced world of investments, staying ahead of the game is crucial for success. With constantly evolving markets and changing trends, it can be challenging to keep up with the latest opportunities. That’s why we’ve put together a list of hot tips to help you stay one step ahead in the investment game for the next year.

1. Technology is King

One of the top investment trends to watch for the next year is the continued dominance of technology. With the rapid advancement of artificial intelligence, blockchain, and cybersecurity, tech companies are at the forefront of innovation. Investing in tech stocks or funds can provide excellent returns as these companies continue to revolutionize the way we live and work.

2. ESG Investing

Environmental, Social, and Governance (ESG) investing is another hot trend that is here to stay. More and more investors are looking to put their money into companies that prioritize sustainability, diversity, and ethical business practices. By aligning your investments with your values, you can not only make a positive impact on the world but also potentially see strong financial returns.

3. Healthcare Innovations

The healthcare sector is always a reliable investment option, but with the recent advancements in telemedicine, biotech, and medical technology, there are even more opportunities for growth. Investing in healthcare companies that are at the forefront of innovation can lead to significant gains as the industry continues to evolve.

4. Real Estate Reimagined

While traditional real estate investments have always been popular, the rise of alternative real estate options such as co-living spaces, data centers, and e-commerce warehouses is changing the game. Investing in these cutting-edge real estate ventures can diversify your portfolio and provide steady returns in a rapidly changing market.

5. Sustainable Energy

As the world shifts towards renewable energy sources, investing in sustainable energy companies is a smart move for the future. Whether it’s solar, wind, or electric vehicle companies, the demand for clean energy solutions is only going to increase. By investing in this sector now, you can position yourself for long-term growth and profitability.

6. Global Opportunities

With advancements in technology and communication, investing in international markets has never been easier. Looking beyond your own borders for investment opportunities can provide diversification and access to emerging markets with high growth potential. Keep an eye on promising economies such as China, India, and Brazil for exciting investment prospects.

7. Diversification is Key

While focusing on specific trends can be lucrative, it’s essential to remember the importance of diversification in your investment portfolio. By spreading your investments across different asset classes and sectors, you can reduce risk and maximize returns. Keep a balanced approach to your investments to ensure long-term financial success.

Stay ahead of the game by keeping a close eye on these hot investment tips for the next year. By staying informed and proactive in your investment decisions, you can position yourself for success in a rapidly changing market. Embrace these trends and watch your portfolio grow!

Top Investment Trends to Watch in the Coming Year